Remediation

Remediation projects across various sectors reveal common themes. They include data quality challenges, regulatory compliance, and the importance of robust governance frameworks.

Accurate, complete, and timely data ensures that impacted customers are correctly identified, calculations are precise, and outcomes are fair and compliant. Poor data quality can lead to significant risks, including regulatory penalties, reputational damage, customer dissatisfaction, and operational inefficiencies.

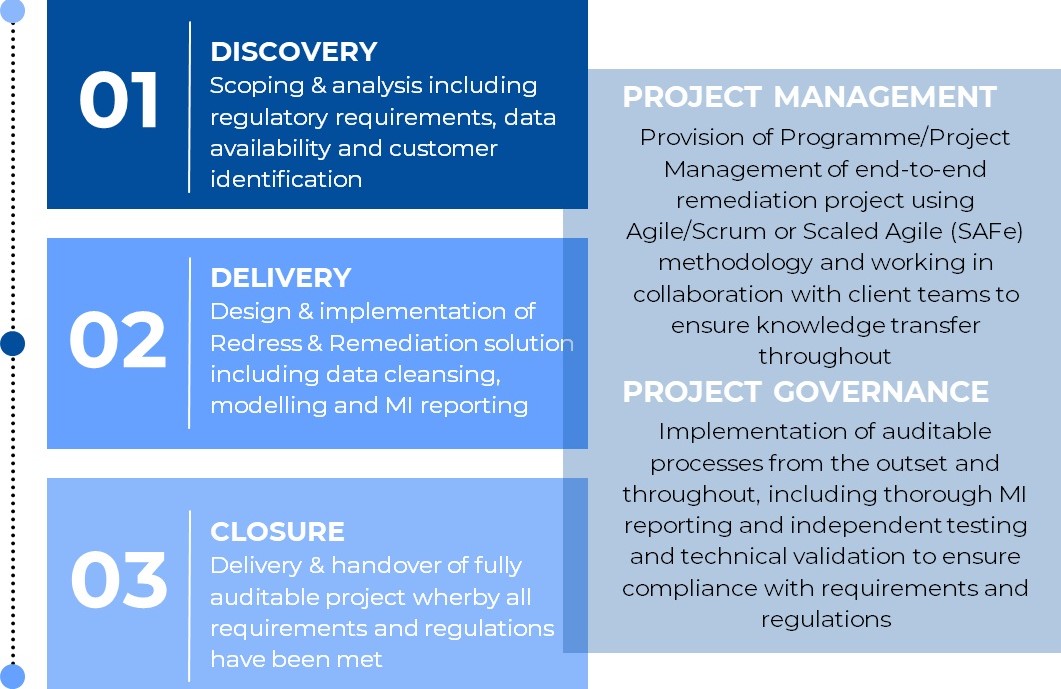

Our Remediation Project Approach

At the core of any remediation scheme is a simple objective: to make things right. Financial services firms often deal with legacy systems, multiple data sources, and large volumes of historic transactions. These factors create challenges such as duplicate records, missing fields, inconsistencies, and unstructured data.

To mitigate these issues, it’s essential to have robust data quality frameworks in place — this includes data cleansing, validation, standardisation, and traceability mechanisms.

Related Insights

Our experience and expertise position us to drive the effective application of AI technologies in remediation projects while enabling benefits for lenders and their customers.

If you would like to know more about our Remediation work, or would like to speak with one of our experts, please complete our contact us form and someone will get back to you shortly.

Lets Take Action Together!